- Home Page

- Closing Techniques

Closing Insurance Sales

Using

the concept of the closing

pyramid.

Every article on this website is like a mini-training school. use the nav bars on either side of this page to locate your area of interest or subject you need help with.

Closing insurance sales can be easy if you understand and implement this closing pyramid concept.

Closing Insurance Sales

Closing insurance sales has a right way and a wrong way. The right way closes many more sales. We know that there are two types of agents when it comes to closing the sale. Which one are you?

- The Quality Fact-Finding Agent Uncovers and Creates The Need by properly asking probing questions.

- the "relationship based financial professional" - helps customers buy.

2.The Product Closer tells the prospect how great the company is and how great the product is. (simply sells features of the policy)

- The “transnational” sales person - sells product and company.

As an agent evolves in the life insurance business, they will learn that the "relationship based financial professional" closing technique is the most effective insurance selling skill to use.

the two different closing pyramids below explains the difference. (see the caption

below each one). Understanding the underlying factors between the right way

and the wrong way to close a sale, is what we will discuss in

this article.

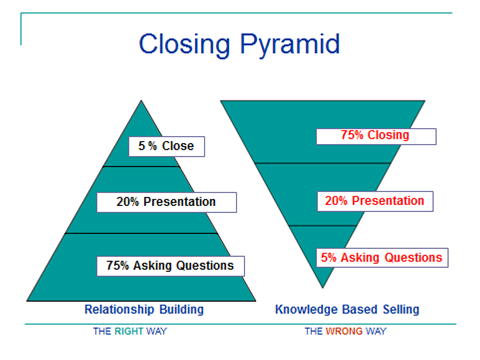

One is labeled Relationship Building and the other is labeled Knowledge Based Selling.

If you are not clear on this,

then you should take a few minutes and read this article

on " selling is a 95% people business and 5% product

knowledge business."

If you have

not watched the Closing

Pyramid

Concept video, do so now, then return to this page.

Take the time to read both pages. Don't just gloss over this and

expect to learn anything. Study habits require patience and skill.

look closely at these two pyramids below. One shows the wrong way and the other, the right way to close. They show you the amount of time, in percentages, that are spent in in each type of closing scenario, which is reflected by the way the pyramids are sitting.

Note the difference in the right way and the wrong way.

Closing insurance sales has a right way and a wrong way. One uses a Relationship Building skill and the other uses a Knowledge Based Selling skill.

Closing insurance sales has a right way and a wrong way. One uses a Relationship Building skill and the other uses a Knowledge Based Selling skill.What's meant by the "Wrong Way" closing pyramid concept ?

Here is how most agents do when closing insurance sales …………

They spend 5% in warm up, 20% doing the presentation, then 75% of their time trying to close because they never really found what it was that was going to trip that prospects trigger. How can you learn anything about anyone's dreams in 5 minutes.

In other words they work the closing pyramid upside down. What they are doing is trying to sell people with their product knowledge. They of course feel their product is the best one out there, and because so, just assume the prospect should buy it because it is such a good product and your such a nice person.

Just don't work that way. You need to change your mindset when closing insurance sales.

Lets

review the "Right

Way" closing pyramid

concept!

The center piece of "closing any insurance sale" should

start after your chit chat is done, and once you sit down at the

kitchen

table. This is when the "right way"

closing pyramid concept should be weaved into

your presentation. It is at this point that we start the interrogation

process, as I call it, and is the most critical part of the interview.

In this first part of your interview, you should be spending 50%-75% of your time asking questions, which will then determine the theme of your presentation. I refer to this as the relationship building part of the closing pyramid process. (The right way)

There are many life insurance selling systems out there, but this process is what separates the really good closers from the mediocre closers, and the life insurance sales leaders from the average life insurance agents.

When do we start closing?

Is it after the presentation? During the presentation. When???

The correct answer is as soon as you walk in the door, starting by using your relationship building skills.

So how do we know what questions we should ask upfront?

By asking the right questions upfront, we can diffuse many of the objections we normally encounter through out the interview and at the close of the sale.

That is why this powerful confidential interview

questionnaire I call the Confidential

Questionnaire was created and fined tuned by me and my agents over

many years. It is the heart of closing insurance sales and is a

proven and tested process.

The questions on this confidential questionnaire provides you the opportunity to find out what it is that this client actually invited you in their home for, while at the same time setting the stage/theme for a sale.

Most agents walk in the door with a preconceived notion on what they want to sell, such as a mortgage term life insurance policy, a universal life insurance policy, financial planning program, etc.

these are usually a form or target marketing.

Sure that works, but if you want bigger life insurance sales and an ongoing future client, and want to close more sales, you need to really find out what their goals in life are. From seeing the kids playing baseball to Mom keeping her dream home, and to make sure those dreams can come through. This is called relationship building.

The Client Interview Questionnaire in Action

Step # 1: The Client Interview Questionnaire:

You absolutely need to spend 50% to 75% of your time asking questions and listening if you really want to increase your life insurance sales closing ratio.

Learn to Listen to what the prospect says in this questionnaire stage. Define their wants and needs. Many times people are just looking for an insurance consultant to help put them on a path of financial security. They are looking for direction.

If you have a financial plan built for yourself, (not just a Life insurance policy) share that with them. Use your relationship building skills and some of these insurance selling tips.

Step # 2: The Actual Sales Presentation:

Now that you have discovered what they want in life, then you spend 20% of your time going through your presentation showing the prospect how your products' benefits and features will take care of the wants and needs you have uncovered.

You start getting them to agree with you along the way. "Mr. Prospect, can you see how this feature will benefit you and your family?" Start getting a series of yes answers as you go along. “Can you see how this concept/idea if initiated will:

Help your children go to college?

Let your family stay in their home if you die?

Provide you with baby sitter and day care money if you loose your wife, etc.

Step # 3: The Close:

In the end, you should only spend about 5% of your time closing insurance sales. Why 5%? Because if you properly went through the questionnaire, you and the prospect should have already agreed upon the wants and needs, and determined if they can afford it and do they want to do something about it today. Briefly review your product/policy and keep it simple.

At this point, you only need to negotiate on which Insurance product best fits the situation, based on what they can afford.

Closing is getting a series of small yes's to questions you ask along the way. You should never have to ask, "Do you want to buy this?"

In the end, it should be, "Mr. Prospect, does this concept make sense to you?

”Can you see how these features would benefit you and your family and help accomplish the goals we talked about?"

Then close with a couple of questions that require an answer to a simple question.

"Would it be more convenient to make annual deposits or monthly deposits?"

Sample closing questions:

Mr. /Mrs. Prospect do you like this idea/concept that I just shared with you? Hopefully they say yes again. Can you see how this will help you accomplish one or all of the financial goals we talked about? “Hopefully another yes”.

Mr. /Mrs. Prospect, you indicated to me in the beginning that you could set aside $75 to $100 per month if you liked what you seen. We can set that up to be transferred from your checking or savings account on a monthly basis into your account with our company, and when the program comes back I will sit down again with you and go through it more detail to make sure you are 100% clear on how it works.

Do you want to start plan A or plan B. This could be a universal life insurance policy or a combination of term and universal life insurance, term and whole life. Always offer a choice. Plan A or Plan B. Never a closed end question, such as do you want to start this? .......

At this point you transition into filling out your application. Mr Prospect if you were to die prematurely, who would you want to receive these proceeds/money?

If the requirement looks like a sizable life insurance sale, then I would get the money commitment and tell them that I would take this info back to office and take some serious time to work out some ideas and then come back and share with them what would work best. I would then reset second interview within a week so that things are still remembered.

Make money selling insurance by using this pyramid process to conduct your interviews and enjoy closing insurance sales that become more profitable.

In the end these clients will provide you with all the free life insurance leads you want in the form of referrals. Closing insurance sales is a process and a skill.

Do it the right way

You absolutely need to spend a good part of your time asking questions and Learning to Listen to your prospect before you even start your presentation.

Doing so, will increase your ability in closing insurance sales as well as increasing your overall life insurance sales closing ratio.

Define their

wants and needs. Many times people are just looking for an insurance

consultant to help put them on a path of financial security.

They are

looking for direction. They also need help with their mindset. Asking

questions should help them with creating the reality of their situation.

And finally, if you have a computerized financial plan built for yourself, (not just a Life insurance policy) share that with them.

Related Articles

More Helpful Closing Techniques and Tips

- Closing on the objection technique.

- Open end closing questions.

- Insurance closing skills

- Three of the dumbest closing mistakes made by insurance agents

- Overcoming insurance objections on singles and newly marrieds

- Are you selling money or life insurance

- How to handle objections

- The art of closing a sale e-book

- Using the third party book to close sales (recommended)

Learn and earn

Life is good, selling is fun, make it better - Sign up for our free monthly newsletter

| Monthly Newsletter Free Please add me to your e-mail list so I can receive all new updates on selling and recruiting. See all back issues |

| Insurance Forum Get answers |

Follow Us

|

Our most popular Self Help e-books Exclusive to our readers |

Looking for proven and tested recruiting concepts. View our Agency Building Manual. |

| More free resources and helpful selling tools |